unemployment tax forgiveness pa

Get Instant Recommendations Trusted Reviews. First figure out your eligibility income by completing a PA-40.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

. Report the Acquisition of a Business. President Joe Biden signed a 19 trillion Covid relief bill Thursday that waives federal tax on up to 10200 of unemployment benefits an individual received in 2020. Online An online application can be filed using our secure website 7 days a week 24 hours.

Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is. In March 2020 Pennsylvania passed legislation requiring employers to give certain information to claimants who are separating from their employment for any reason. File and Pay Quarterly Wage.

Make an Online Payment. To apply for Tax Forgiveness submit a completed PA Schedule SP when you file your PA-40 personal income tax return. We Can Help Suspend Collections Liens Levies Wage Garnishments.

In cases like this the funds can only be recouped by the state if someone with an overpayment applies for unemployment benefits again in the next three years the state can. Record tax paid to other states or countries. For PA purposes qualifying.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Provides a reduction in tax liability and Forgives. Ad Compare the Top Tax Forgiveness and Find the One Thats Best for You.

If your modified adjusted gross income AGI is less than 150000 the. A 900 billion relief law passed in December let states opt to waive overpayments of benefits. It ranges from 0 to 100 in 10 increments.

These benefits are not taxable by the Commonwealth of Pennsylvania and local governments. UC Unemployment Benefits UC Handbook Overpayments and. See the Top 10 Tax Forgiveness.

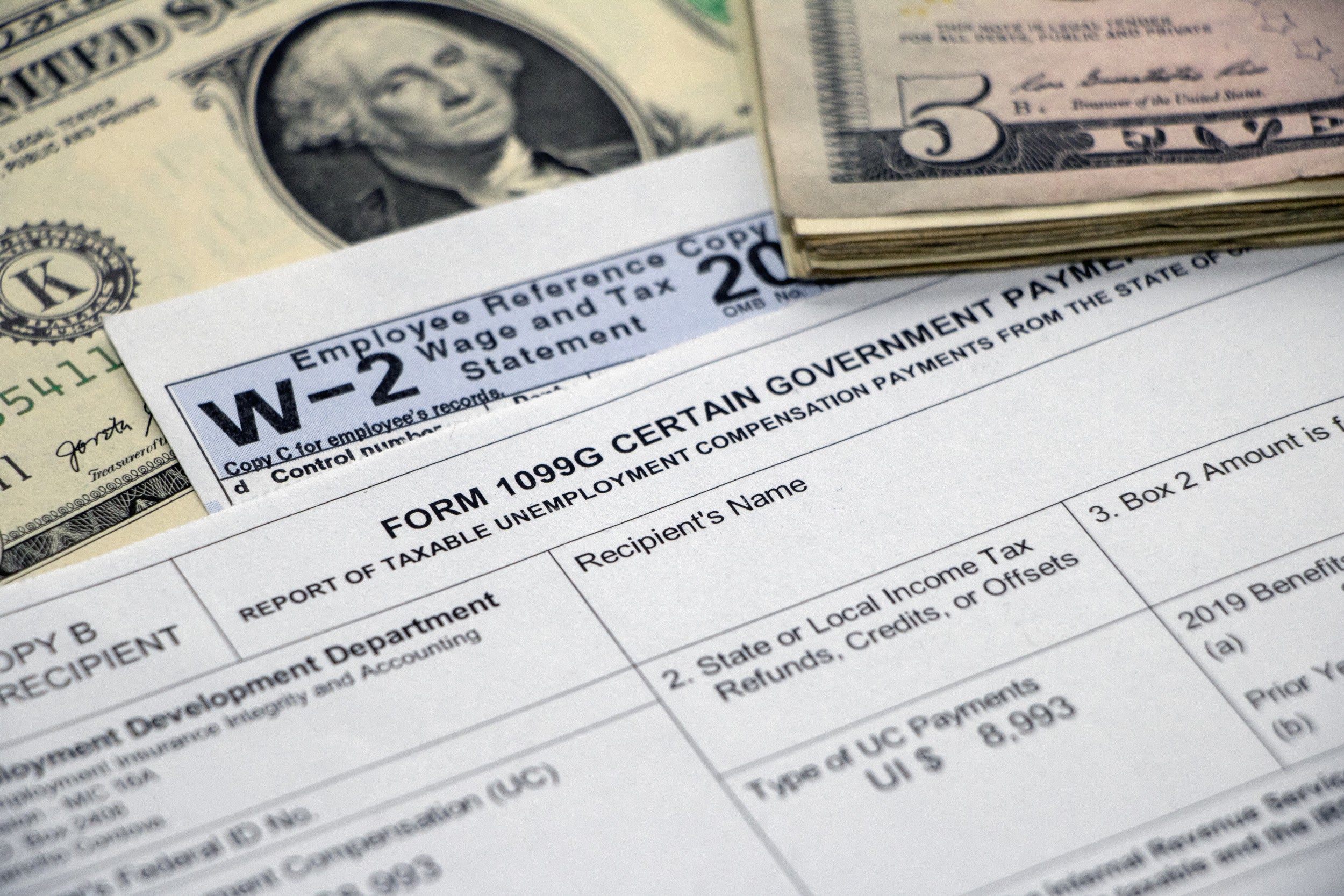

Tips for Tax Forgiveness. Individuals should receive a Form 1099-G showing. The IRS Can be Very Reasonable if You Know How They Work.

The wage base recently has been. Register for a UC Tax Account Number. See the Top 10 Tax Forgiveness.

Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. Ad Pay 0 to File all Federal Tax Returns No Upgrades 100 Accurate. Record the your PA tax liability from Line 12 of your PA-40.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. You may choose to have federal income tax withheld from your benefit payments at the rate of. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income.

Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions. You should file your UC application for benefits using one of the following methods. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

Get Instant Recommendations Trusted Reviews. IRS sends out 4 million refunds for 2020 unemployment benefit overpayments. The more dependent children you have and the less income you make the higher the percentage of tax forgiveness you will.

UCMS provides employers with an online platform to view andor perform the following. Verifying your eligibility for Tax Forgiveness based on income tables and what forms to fill out if you qualify. Up to 25 cash back That amount known as the taxable wage base currently is set to increase by 250 per year in Pennsylvania at least until 2018.

For example a family of four couple with two dependent. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary. To claim this credit it is necessary that a taxpayer file a PA-40.

Now states who opt into that forgiveness must issue refunds to workers whod. Ad Compare the Top Tax Forgiveness and Find the One Thats Best for You. Millions of people who overpaid taxes on their 2020 unemployment benefits will start getting.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Office of UC Benefits. The purpose is to cut.

Register to Do Business in PA. The instructions for filling out PA Schedule SP are included in PA. Checks or money orders for all federal and state overpayments should be made payable to the PA UC Fund and mailed to.

See How We Can Help. Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

In Part D calculate the amount of your Tax Forgiveness. Ad Use our tax forgiveness calculator to estimate potential relief available. Get Information About Starting a Business in PA.

Submit Amend View and Print Quarterly Tax Reports.

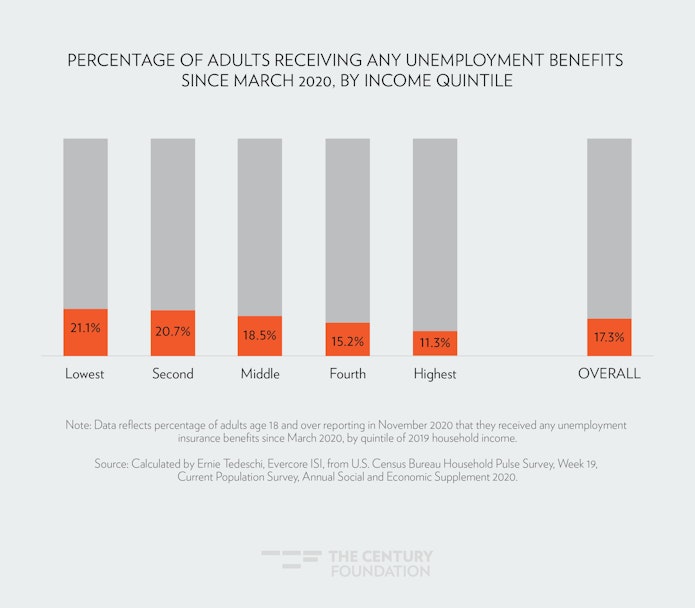

The Case For Forgiving Taxes On Pandemic Unemployment Aid

United Kingdom 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

The Case For Forgiving Taxes On Pandemic Unemployment Aid

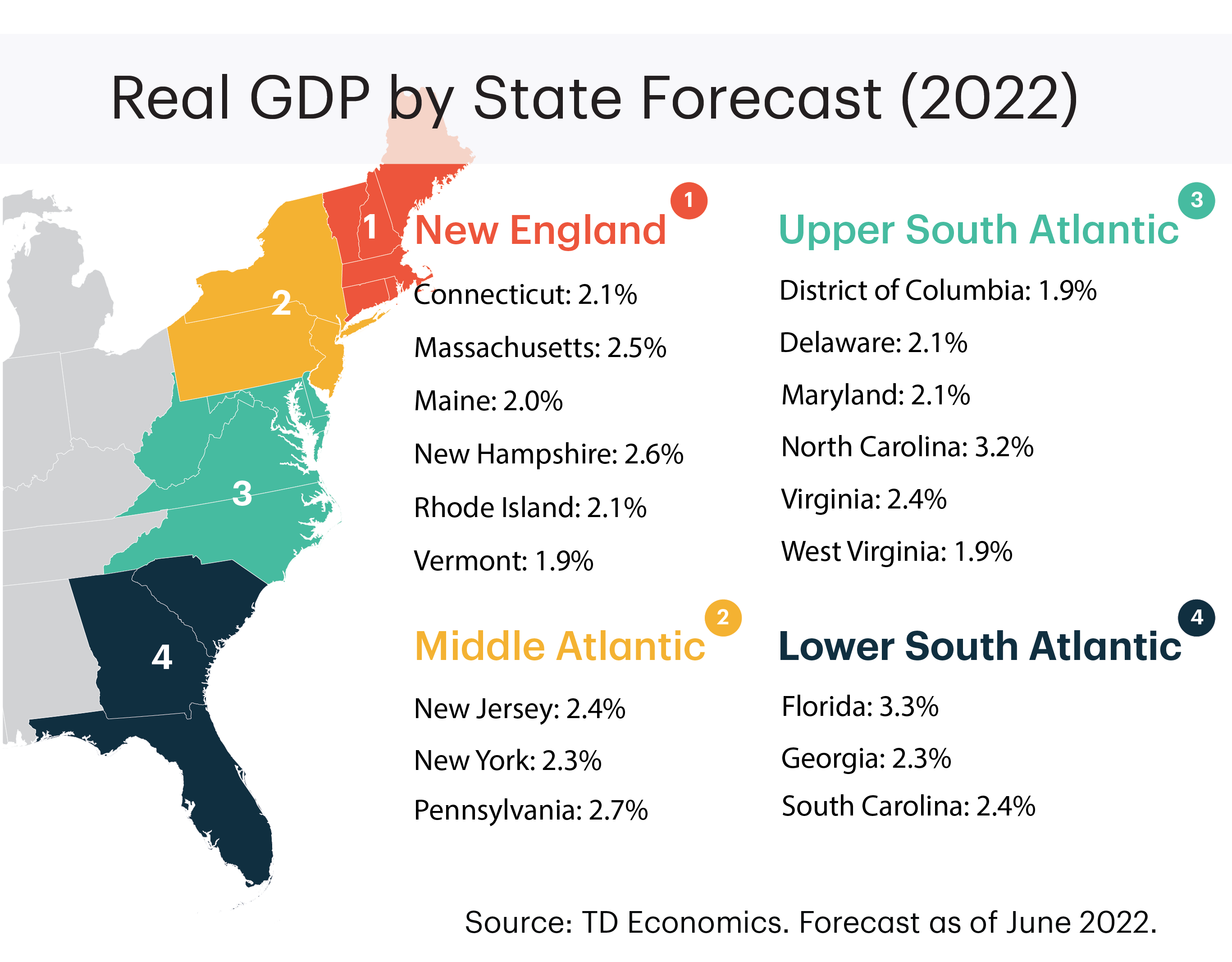

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Felder Demands Tax Relief Again Ny State Senate

Don T Forget To Pay Income Tax On Your Unemployment Benefits Omni Tax Help